Working as an extension of your team we will understand what is important to you and develop bespoke solutions that meet your requirements, as well as those of the law

Research & Development

Research & Development (R&D) tax relief can provide valuable financial support for businesses investing in innovation and developing new processes, products or services.

Our specialist team of Chartered Tax Advisors and Chartered Accountants, alongside our technical team encompassing Engineers, Software Specialists, and an ex-HMRC inspector, can assist businesses with preparing robust, compliant R&D tax relief claims.

R&D Overview

Our team have decades of experience in preparing and defending R&D claims and are on hand to assist with the entire life cycle of an R&D claim. Our expertise allows us to forensically analyse R&D claims to ensure that every claim prepared by us is robust, compliant, and in line with the ever-changing and complex R&D landscape.

We take a flexible and pragmatic approach; the businesses we work with are sophisticated and often have been claiming R&D tax credits for years. As a result, we can flex our service to suit the need of the business without compromising on quality.

How we can support you

- Professional Conduct in Relation to Taxation reviews

- Health-check of existing R&D tax credit claims

- End-to-end preparation and submission of R&D claims

- Assistance with part of an R&D claim i.e. technical descriptions or financial analysis. This works particularly well for businesses with established in-house tax functions

- Assistance with additional information and advanced notification forms

- Assistance with disclosures to HMRC and penalty mitigation if errors are made

- Enquiry support and defence, including alternative dispute resolution

- Training, including webinars and on-site training days

The R&D scheme is changing

For accounting periods beginning on or after 1 April 2024, the R&D scheme is changing.

There will now be the merged scheme, which broadly mirrors the existing RDEC regime for large companies, and the R&D intensive scheme, otherwise known as ERIS.

The merged scheme will apply to all companies, unless the claimant company is a loss-making SME (subject to the usual thresholds) with over 40% of its total expenditure relating to R&D. There are nuances around other group companies and intangible assets that also need to be taken into consideration. The biggest changes to the schemes are firstly, detailed guidance on subcontracting and who can claim, and secondly the disallowance of overseas contractors and externally provided workers.

This will be a definitive transition for March year ends, however not for all. For example, December year ends will find that the years ended 31 December 2023 and 2024 will remain under the existing schemes, whilst the year ended 31 December 2025 will be the first year that the changes come into effect.

The changes are vast and nuanced, so please reach out to us for any queries.

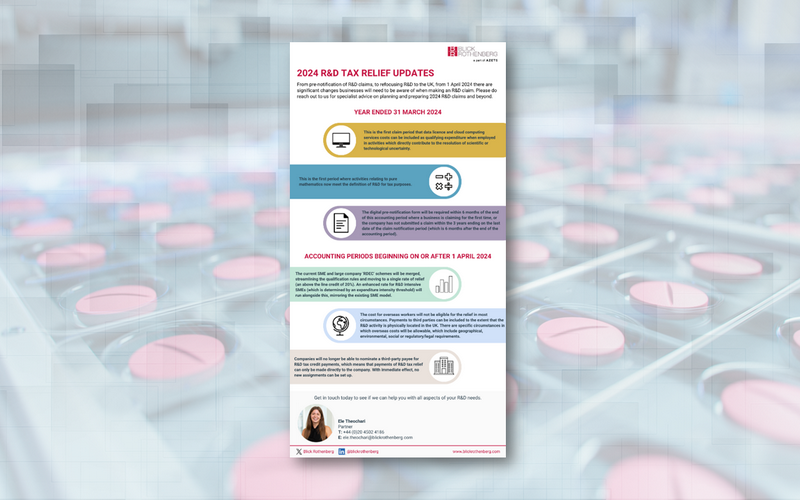

R&D Tax Relief Updates

From pre-notification of R&D claims, to refocussing R&D to the UK, from 1 April 2024 there are significant changes businesses will need to be aware of when making an R&D claim.

Our infographic outlines the R&D tax relief updates and changes businesses need to be aware of.

Our People, your Partners

We work with a wide range of clients from companies listed in the UK and overseas, to entrepreneurial businesses, family offices and funds. We also work with clients which are audited by other organisations but prefer an independent firm to deliver tax advisory and compliance work.

Blick Rothenberg’s multi-disciplinary corporate tax practice will ensure not only your company’s full compliance with the complex requirements of UK tax law, we will help you avoid future tax pitfalls and their potential impact on your commercial transactions.

Our advice to you will be pragmatic, commercial and insightful, to help you make more informed business decisions and guide you through complex tax legislation. Working as an extension of your team we will understand what is important to you and develop bespoke solutions that meet your requirements, as well as those of the law.

Ele Theochari talks to Paul Noble about HMRC activity around R&D Tax credit claims

Paul explains that HMRC have identified there is abuse in the system, there have been claims that are fraudulent or lacking in substance and that has caused them to ramp up their enforcement work in this area.

HMRC can start an enquiry into any claim either randomly or based on having intelligence information.

Would you like to know more

If you would like to discuss any of the above in more detail, please contact one of the team below, Ele Theochari using the form below or through your usual Blick Rothenberg contact.

Our experts

Contact Ele