Latest publications

Agricultural Property Relief and Business Property Relief – Flyer

Establishing a Business in the UK Guide – 2025

Transaction Services

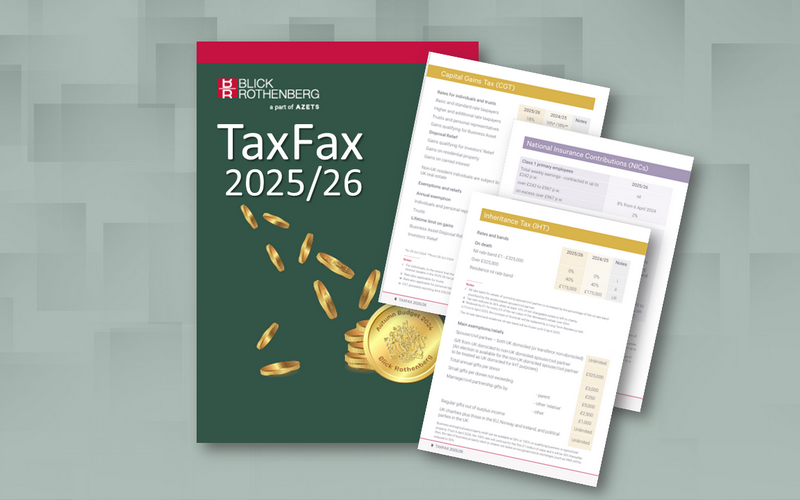

TaxFax 2025/26 – March 2025 Updated

Tax Planning Guide 2025

TaxFax 2025/26

A Guide to Research and Development Tax Relief

Trust Registration Service

TaxFax 2024/25 – US-UK

Pay Transparency flyer – French version

R&D tax relief updates