Spring Budget 2024

Spring Budget 2024:

Chancellor’s ‘generous’ National Insurance cut will increase tax for millions

Lower earners worse off due to frozen tax thresholds

The Chancellor, Jeremy Hunt’s 2% National Insurance (‘NIC’) cut may not be as generous as he proclaimed at last week’s Spring Budget.

Nimesh Shah, said

The £10bn splurge on the 2% NIC cut was hailed by the Government as offering the lowest effective personal tax rate in almost 50 years. But the continued big freeze on personal tax allowances and thresholds is more than offsetting the benefit of the NIC reduction, with the Office for Budget Responsibility (‘OBR’) forecasting the Government will still yield an extra £6.6bn in 2024/25 despite the big tax giveaway.

Freezing income tax thresholds until 2028/29 means that more than three million people will be pulled into the higher and additional rates of income tax over the next five years, leading to a net rise in tax receipts of £19.7 billion.

The NIC cuts announced in the 2023 Autumn Statement and 2024 Spring Budget reverse around a half of the total additional tax revenue raised from the freezing of thresholds in 2028/29. Over the next 5 tax years, frozen thresholds and allowances will yield the government £174bn in total – but after deducting the ‘NIC cuts’, it will be worth an extra £71.7bn.

These are staggering numbers, and you can see why the Government (and the Labour Party opposition) do not want to give up this measure as it has been and will be a ‘cash cow’ for HM Treasury without people really knowing or understanding the drastic effect.

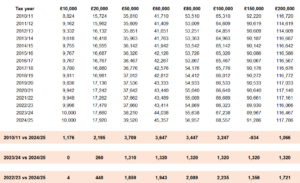

Lower earners are disproportionately disadvantaged from the ‘big freeze’. Had the personal allowance risen in line with inflation, it would be now worth £15,220 according to the OBR. This means that someone earning £20,000 is £115 worse-off with the Government’s tax raising and tax-cutting measures.

But fiscal drag has been an issue since 2010, and the recent move to freeze tax allowances and thresholds is making the problem more severe. Last month, The TaxPayers’ Alliance said the number of people paying income tax had increased by 4.5m since 2010. Of that number, an additional 1.7m people are paying the basic rate of income tax. Whilst the personal allowance increased very quickly to a five-figure sum (of £10,000) during the time of the Coalition Government, it hasn’t actually increased enough since 2010 to date.

The increase to the personal allowance has been a modest £6,095, or put another way, around £450 for each year of this Government. With the personal allowance being frozen at £12,570 since 2021, and with that to remain the case until 2028, more people are going to be dragged into paying income tax. The issue has been exacerbated further by record high inflation during the cost-of-living crisis.

Someone earning £20,000 is only £2,195 better-off now than in 2010/11, or a measly £194 per annum. (see chart below)

Would you like to know more?

If you would like to discuss any of the above in more detail, please get in touch with your usual Blick Rothenberg contact or Nimesh Shah using the form below.

Contact Nimesh

You may also be interested in

Spring Budget 2024: Analysis

Spring Budget 2024: Winners and Losers