The three key aspects are cost, technical complexities and policy

Global Mobility Policy

Immigration and relocation arrangements are generally the main areas of focus when planning a move. However, an area that is often overlooked is the employee’s net pay and cost of living expenses as well as the employee’s and employer’s reporting obligations in both the home and host locations.

The three key aspects are cost (financial impact on the business and the employee), technical complexities (interaction of international tax and social security rules) and policy (application of assignment policies to ensure consistency but also tax efficiency).

Cost

Sending an employee abroad can be a significant investment, both in terms of cost, but also of time. And, where that time is limited, the period over which that return on investment is generated needs careful consideration.

Many companies struggle to demonstrate the return on this investment. It can be easy to look at cost (but not always), whereas the return can be more abstract, and over a longer period.

It can be unclear whether the return should even be measured during the assignment in terms of improving business performance where the assignee brings their experience, or after the assignment when they return home with enhanced skills that enable them to add more value to their sending office.

Helping our clients understand the challenges, and being clear that they are asking the right questions, can maximise the focus on how to maximise the return, rather than minimise the cost.

There are several steps to consider when putting together the compensation package of an assignee:

- Will the individual’s affordability be impacted?

- Are they going to a location where they will face additional challenges e.g. political instability?

- What is the host country’s tax regime?

- Are their tax reliefs available?

We can put together estimated calculations for you to understand the difference in the cost of living between the home and host locations, to help you work out an appropriate allowance for your expat or estimate what your expat’s net pay will be.

Technical complexities

The UK tax system is complex. As such, an expat’s UK tax position should be carefully considered for a number of reasons:

- The UK tax authorities do not accept misunderstanding the rules as a valid reason for getting it wrong.

- UK payroll reporting is done on a real time basis. Expatriates who remain on their home country payroll and are required to be on a UK payroll can be included on a special payroll arrangement.

- We are seeing companies move away from the traditional expat secondment. Remote working is becoming increasingly common. However, this arrangement comes with risks.

- UK income tax relief can be claimed for employee and employer contributions made to certain foreign pensions. However, the tax relief claim is restricted based on income level.

- Expatriates who have deferred compensation are required to report and pay tax and social security in the UK on at least the gain that relates to the period they work in the UK.

- Employees no longer have to go on assignment, and where possible employers now encourage them to travel to the UK for work. International business travelling comes with risks. Find out more.

Policy

Companies send their employees abroad for a variety of reasons and durations.

A historical preference for long term senior assignments has been supplemented or replaced by shorter term, developmental assignments at various points in the employee’s career. Increasingly, assignments can even be virtual, which creates a new range of challenges, particularly around reward methodology.

Assignments can be initiated by the company to meet growth needs, or by employees who may need to relocate for personal reasons.

Having a Global Mobility policy that is clear about the reasons for the assignment, what support is being provided, whilst also addressing the HR aspects of talent management and career development ensures that expectations are clear up front, minimising risk and maximising the return on investment made into the assignment.

We provide our clients with:

- In-depth understanding of the relocation landscape, including the range and scale of different employee benefits and the supply chain to support assignment success

- Experience in designing reward packages to incentivise mobility, and ensure employee engagement is maximised, enabling them to focus on the task they were assigned for

- Considerable experience and expertise

- A perspective of having also been assignees on a variety of programmes and policies, and of having managed global mobility programmes in companies of varying sizes

Five key questions to consider

We suggest there are five key tax-related questions to consider with any international assignment:

- Where will income tax be due?

- Where should employer and employee social security tax be paid?

- What employer payroll and reporting obligations are there?

- What is the assignment policy and terms?

- How much will the assignment cost?

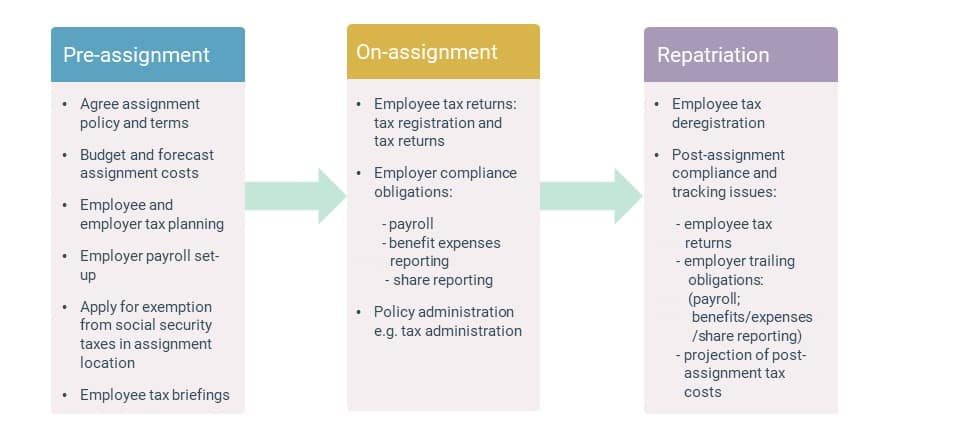

We consider each of these during the main phases of the assignment:

You can find more information on the above in our Tax and Payroll Guide and Assignment checklist.

For more information, please contact your usual Blick Rothenberg contact or get in touch with one of our experts.

Global Mobility Policy Services

Contact Rehana Earle

Insights

Ele Theochari has been appointed as Vice President of The Association of Taxation Technicians

Retailers Both Online and High Street Struggle Amid Rising Staffing Costs

Is the End of the Triple Lock Pension Inevitable?

Early Careers

Your future begins here