Travel rule changes could have tax implications

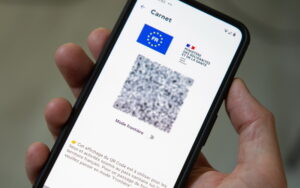

Electronic authorisation systems to digitise travel

Lisa Bartholdy and Rehana Earle explain imminent changes to electronic authorisation systems which could have potential implications for the tax position of certain individuals…

In an era where security is paramount, immigration and border control digital transformation are continuing to pick up pace around the world.

The European Union and the United Kingdom are too on the brink of a transformative change with an ambition to make their borders fully digitised by the end of 2025, each introducing their own versions of electronic systems that will reshape the way we travel. Such systems will play a pivotal role in fortifying safety measures and border controls, enabling authorities to conduct thorough pre-arrival screening.

Individuals who are not currently required to apply for a visa, such as tourists and business travellers from non-visa national countries, will be most affected. They will be required to provide proof of a valid electronic authorisation prior to boarding a flight, train, boat, or other carrier.

Travelling to Europe

In 2024, the European Union is set to introduce the ETIAS (European Travel Information and Authorization System) alongside EES (Entry/Exit System).

This is a pre-travel authorisation system designed to screen nationals that are not subject to visa requirements to stay in the Schengen Area (excluding Ireland) or Bulgaria, Cyprus or Romania.

Nationals of the US, UK, Canada, Australia, New Zealand, and other countries that are not required to apply for a Schengen visit visa will have to make an online application to obtain authorisation to travel.

Furthermore, the European Union is also set to implement the EES with the aim of preserving the integrity of the Schengen Zone. This is an entry and exit monitoring system that will track the movements of all travellers, both EU and non-EU nationals, across borders. The EES will work in tandem with ETIAS and will help establish a comprehensive database of overstayers with the aim of making European borders more secure.

Historically, tourists and business travellers from such countries have not been keeping a complete record of the days spent on the continent and it was effectively up to border officers to ensure compliance with the immigration rules. The introduction of these systems will mean that travellers will now have to be much more conscious of the time they spend in Europe as overstaying may have adverse immigration consequences, including travel bans, thus making record keeping essential.

Tax consequences

There may also be tax consequences to consider. Historically tax and immigration systems haven’t been fully integrated, but with electronic access to data, it will be much easier for tax authorities to see who is spending time in a country.

This may give rise to compliance and reporting obligations across a spectrum of taxes for both the employee and their employer. Understanding the tax landscape, including whether there are any agreements that can be put in place with the tax authorities to reduce sometimes burdensome tax and reporting obligations, will be key.

In the past, organisations have often found it hard to track business travellers due to a lack of data and internal processes, but if the authorities have visibility as to who is travelling, it will be even more important for organisations to find ways to understand which employees are travelling for business, what they are doing and what the implications are.

Once approved, the ETIAS will be valid for a period of three years or until the expiration of the traveller’s passport, whichever comes first and will be valid for unlimited trips of 90 days within a 180-day period. However, travellers with a granted ETIAS are not guaranteed entry, as entry rights are still subject to border authorities’ discretion.

Travelling to the United Kingdom

All Europeans (excluding Irish nationals) and other nationals that do not require visitor visas to travel to the United Kingdom (such as the US, Australia, New Zealand and other countries) either visiting or transiting through the UK will need to apply for an ETA (Electronic Travel Authorisation) before arrival. We expect a phased roll out over the course, starting with Qatar nationals from 15 November 2023 and other countries being added throughout 2024.

ETA will be valid for two years or until the individual’s passport expires (whichever the sooner) and allows for multiple visits to the United Kingdom providing these are within the visitor rules. If the application is refused, the individual will need to apply for a visa to seek permission to come to the UK. As with ETIAS, an ETA approval amounts to permission to travel, but is not a visa and does not guarantee entry to the UK.

If an individual is travelling for business purposes, care will need to be taken with regard to the nature of the duties being performed. Some duties may require an employer to administer UK payroll reporting unless an exemption can be applied under an Appendix 4 (Short Term Business Visitor Agreement). In addition to tax, social security impact should also be considered with an A1 or a Certificate of Coverage obtained from the relevant tax authorities, where a bi-lateral agreement is in place, to continue paying social security contributions in one jurisdiction only. Employers may also need to consider broader tax issues such as the risk of creating a permanent establishment for corporate tax purposes.

Preparing for change

The introduction of electronic authorisation systems is transforming the way tourists and business travellers will experience travelling to the United Kingdom and Europe. Individuals will have to plan their travels and ensure a valid authorisation in advance of their journey.

One of the challenges of these systems will be tracking authorisation expiry dates. ETIAS and ETA, you could also throw the US ESTA into the mix for good measure, all have varying periods of validity. This will be particularly challenging for frequent travellers who will have multiple authorisations with different start and end dates. Using mobile applications for both the day counts and authorisation validity dates; or diary reminders to ensure that these authorisations are renewed on time will be essential.

Although these systems impose new compliance measures for non-visa nationals, they will also streamline the entry process. It will still be advisable for travellers to keep up to date with developments of the relevant regulations and any changes made to the authorisation systems in the future to ensure both immigration and tax compliance.

Alisa Bartholdy is a Manager and Solicitor at the global immigration law firm Fragomen and Rehana Earle is a Partner at Blick Rothenberg

This article was first published by ProfessionalAdvisor.com and is reproduced by knid permission

Would you like to know more?

If you would like to discuss how we can help you please speak with your usual Blick Rothenberg contact or Rehana Earle using the form below.

Contact Rehana

You may also be interested in

Unlocking Growth: What the Government’s 2025 Industrial Strategy Means for the UK’s Creative Sector

A ray of hope for the Property Market: HMRC transaction data suggests recovery momentum