Chancellor's Emergency Statement

Impact of 17 October statement by Jeremy Hunt

Jeremy Hunt, the UK’s fourth Chancellor of 2022 has completely ripped apart Kwasi Kwarteng’s September’s Mini-Budget, and left a stark warning that the Government may have to go further on taxes at the Medium-Term Fiscal Statement on 31 October.

Following the U-turns on abolishing the 45% additional rate of Income Tax, and announcing last Friday that Corporation Tax will increase to 25% from April 2023, Jeremy Hunt has confirmed that almost all the measures announced in the September Mini-Budget will be cancelled.

The IR35 off-payroll rules will remain in their current form, dividend tax rates will not be reduced by 1.25% next April, the VAT-free shopping scheme will not go ahead and alcohol duties will no longer be frozen. The earlier U-turns and today’s announcements will be worth £32 billion to the Government.

The 1.25% reversal to National Insurance, taking effect from 6 November, and the cut to Stamp Duty Land Tax (SDLT) will remain in place. The permanent £1 million Annual Investment Allowance, enhancements to the Seed Enterprise Investment Scheme and extension to the Company Share Option Plan rules also survive, but they are minor refinements at best.

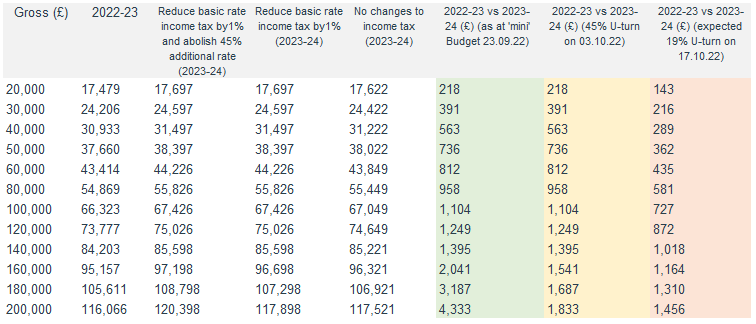

Crucially, Rishi Sunak’s promise to reduce the basic rate of income tax to 19% from April 2024, which was brought forward by a year by Kwasi Kwarteng, will not proceed at all, saving HM Treasury an estimated £5 billion per annum. This means that someone earning £50,000 will be £362 better-off compared to 2022/23, but will be somewhat disappointed when they were expecting a £736 benefit following the Mini-Budget announcements.

Top earners have seen their Mini-Budget savings quickly clawed back – someone earning £200,000 will still be better-off next tax year by almost £1,500, because of the reversal of the 1.25% National Insurance increase, but they were originally expecting a benefit of over £4,300.

Jeremy Hunt has gone further than most expected, scaling back the universal Energy Price Guarantee to now run only until next April, with a review commissioned on how energy support should be delivered and targeted in the future.

In less than four weeks since the Mini-Budget, the Government has moved to a different end of the spectrum, and relegated all of Liz Truss’ leadership plans. Crucially, today’s announcements are unlikely to be the end, with further tax raising measures now expected at the Medium-Term Fiscal Statement on 31 October.

Notes:

1. Tax Rates and allowances are actual published rates for 2022/232

2. National Insurance rates reduced by 1.25% from 6 November 2022

Would you like to know more?

If you have any questions about the Government’s announcement and how it may impact you, please get in touch with your usual Blick Rothenberg contact or Nimesh Shah using the details on this page.

You can also visit our Budget Hub, where you can find our commentary and a range of insights to help you better understand how the Budget may affect you.

Contact Nimesh

You may also be interested in

Is the End of the Triple Lock Pension Inevitable?

The UK is a stable, open and innovation-driven market for Japanese firms to invest in