We are a leading tax, accounting and business advisory firm founded on personal integrity and technical expertise. For us, being an advisor is an absolute privilege and you can count on us to build strong, long-lasting relationships with you, based on mutual trust.

Welcome to Blick Rothenberg

Blick Rothenberg wins Accountancy Firm of the Year

Blick Rothenberg won Accountancy Firm of the Year at the Citywealth Magic Circle Awards held in The Biltmore Mayfair hotel in London on 14 May.

The Citywealth Magic Circle Awards honour top-performing advisors and managers in global private wealth from leading law firms and private banks to elite trustees, accountants, and multi-family offices.

The Accountancy Firm of the Year award is open to companies who have had an excellent year in terms of growth, development and innovation, as well as a positive social impact.

Making Tax Digital

From 6 April 2026, HMRC’s Making Tax Digital for Income Tax Self-Assessment (MTD ITSA) will be mandatory for sole traders and landlords earning over £50,000 annually.

Suzanne Briggs, Private Client Partner, Stephanie Levin, Head of Entrepreneurial Services and Audit, Accounting and Outsourcing Partner and Mitesh Khoot, Private Client Manager discuss what impacted individuals should be doing now to prepare for the changes.

The Tax Factor

Farage, Phoenixing and the Future of Tax Agents

This week on The Tax Factor, Malli Kini and Stefanie Tremain show why precision matters in both politics and tax with Nigel Farage learning the hard way that there’s a big difference between “I” and “we.”

The conversation then turns to the ICAEW’s warning about Government plans to regulate tax agents. While the idea might sound straightforward, could it actually make the system less effective rather than more secure?

And finally, the National Audit Office reports that HMRC is losing billions to small business tax evasion including more than £800 million through

Blick Rothenberg continues partnership with The Lloyd’s British Business Excellence Awards

We are extremely pleased to announce that our partnership with The Lloyds British Business Excellence Awards will continue into a second year and see the introduction of the brand new ‘Blick Rothenberg Mid-Market Growth Business of the Year’ category for 2025.

The Lloyds British Business Excellence Awards is the UK’s largest and most prestigious business awards programme that celebrates the cream of the crop across all industries, championing sustainability, diversity, equality and those that have transcended expectations and limitations throughout the year.

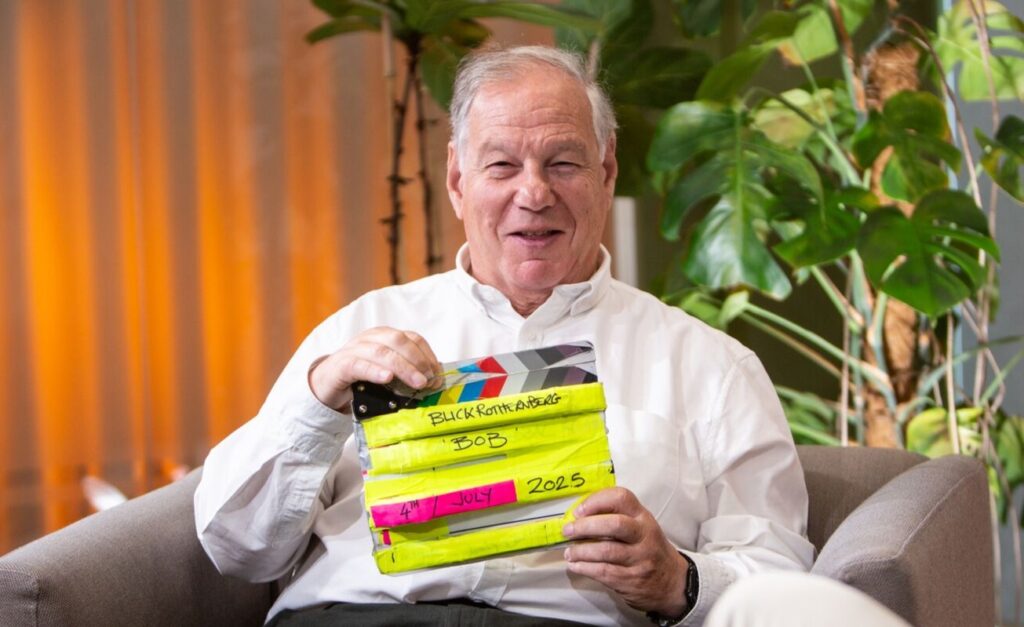

Celebrating 80 years

In 2025, Blick Rothenberg marks 80 years of delivering trusted, high-quality advice to clients in the UK and around the world

Former Senior and Managing Partner Bob Rothenberg shares a brief history of the firm – from its founding by his father in 1945, to the present day – and looks ahead with the same passion, integrity and commitment that have shaped the firm’s journey.