Search

Start your search

Showing results for robert salter

Filter results

HMRC’s IR35 must go for the sake of the UK economy

The tax filing deadline may have been extended, but taxpayers should pay today

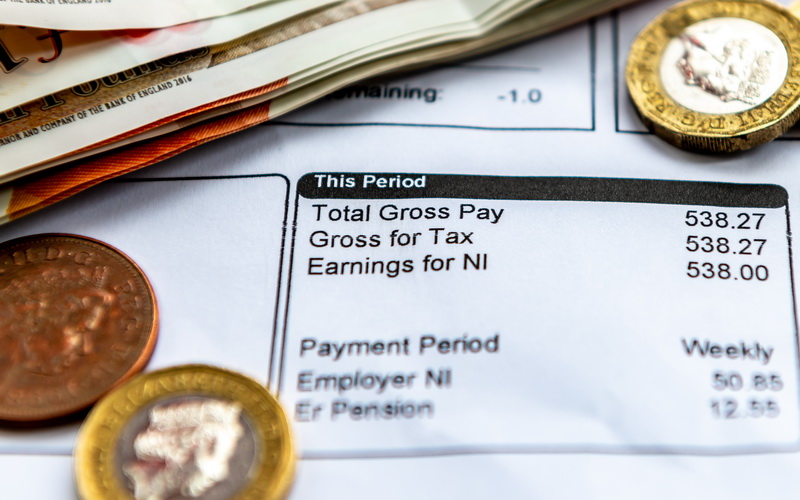

Workers who are paid weekly could face a 2023-2024 tax liability

Taxpayers with eligible children should pro-actively register for child benefit

Spotlight on… Reclaiming NICs on company car allowances

Are business lunches tax-free for employees?

Spring Budget 2024: High Income Child Benefit Charge and National Insurance

HMRC increases the interest charged on late payments

Government Earnings Threshold change will result in taxpayers overpaying

Employees held back by Government’s refusal to allow tax relief on self-funded training and development

Allowing staff to have a Christmas Workation