International business travellers

A rapidly changing landscape: the rising costs and growing tax risks for international organisations

An increasingly globalised world needs internationally mobile employees

Background

The number of employees working outside of their home country is soaring and this trend is set to continue; it is predicted that the number of globally mobile employees will double by 2020. The UK is, and will remain, a key global destination for international business travellers (IBTs).

Whilst a highly flexible global workforce provides greater opportunities for international organisations to fulfil resourcing needs and quickly deploy talent globally to the areas that need it, this rapidly changing landscape also brings key challenges which need to be managed carefully and proactively.

The UK, like many tax authorities around the world, is seeking new ways to raise revenues and is more focused than ever on employers of IBTs. The regulatory environment is being tightened and heavy penalties are being imposed for non-compliance.

The issue

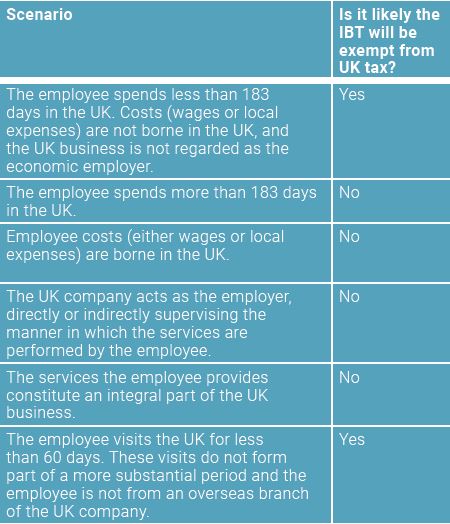

The Courts have now confirmed that an employee simply spending less than 183 days in the UK is no longer sufficient for UK tax to be avoided. Other factors are now also important, such as where the employment costs are borne and whether the employee is considered to have an integral role in the UK business. Additionally, where there is no Short Term Business Visitor (STBV) agreement in place, Her Majesty’s Revenue & Customs (HMRC) have confirmed that they will no longer accept employer non-compliance. They require all UK businesses to perform UK payroll reporting for most IBTs, even if they continue to be employed and paid overseas.

When is UK tax due?

The UK has negotiated tax treaty agreements with most countries and therefore no UK tax is due provided the conditions stipulated in the treaty agreement are met.

Care should be taken where it is claimed that the visiting employee is not connected to the UK business or that costs are not borne here. A counter argument and risk might be that the overseas employee has therefore created a “permanent establishment” of the overseas company in the UK and therefore a corporate tax reporting obligation.

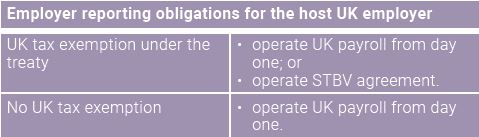

Employer reporting obligations

If the overseas employer does not have a UK presence and the overseas employee is under the control or working at a UK business, that UK business may be regarded as a “host employer”, even for short periods of time. HMRC now expect a host UK employer to either obtain a written STBV agreement to avoid operating a UK payroll or take on the UK payroll obligations, even if they do not pay the employee. The change can apply to those on ‘formal’ assignments or simply in the UK for extended business trips.

Special UK payroll arrangements for very short-term business visitors liable to UK tax

From 2015/16, a UK company can apply for a special arrangement with HMRC for business visitors who are performing substantive duties in the UK but are unable to claim exemption from UK tax under a Tax Treaty or the 60 day concession. Non-resident directors of the UK company must not be included in this arrangement. UK social security/ National Insurance rules should also be applied as normal.

Under the special UK payroll arrangement, the overseas employee must work no more than 30 UK workdays in a tax year otherwise UK PAYE withholding tax should be operated in the usual way. Under the arrangement, the overseas employee does not need to file a UK return and the UK company does not need to operate a shadow payroll or file Form P11Ds. Instead the employer only needs to report the visitor to HMRC at the end of the year and pay any UK tax due.

UK employer and employee social security taxes

National Insurance contributions will not be due, provided the employee meets the conditions of a relevant Social Security agreement and the employer applies for a Certificate of Coverage/ A1. UK social security tax will generally not be due where there is no Social Security agreement, provided the employee remains employed outside the UK and is here for less than 52 weeks.

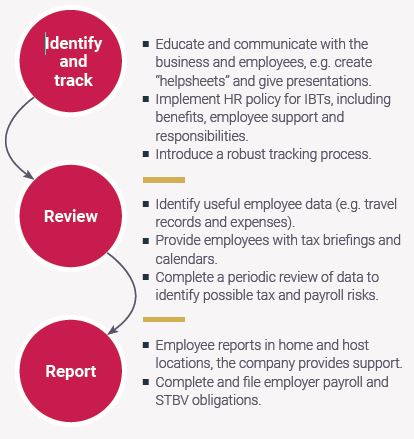

How to manage your international business travellers

Blick Rothenberg and international employers

In an increasingly globalised world, business and individuals face a wide range of tax challenges and opportunities every day. Blick Rothenberg produce a variety of thought leadership and other materials to help keep you informed of the tax issues that affect you.

Blick Rothenberg is a leading accountancy firm and supports over 800 international businesses. Our specialist Global Mobility team has considerable experience in helping organisations and individuals who work across international borders with tax and payroll compliance, tax planning and related policy issues.

Blick Rothenberg was named winner of the Best International and Expatriate Tax Team at the Taxation Awards 2015. Recognised as a mark of excellence within the sector, the awards were judged by a panel of leading professionals and officers of major tax institutions. We have also beenhighly commended by the Chartered Institute of Payroll Professionals (CIPP) as being a leading firm in the provision of international payroll services.

For more information, please contact your usual Blick Rothenberg contact or Mark Abbs using the form below.

Contact Mark

You may also be interested in

AI is a support for businesses but not a solution

Labour’s plans won’t scratch the surface of the tax gap